hotel tax calculator florida

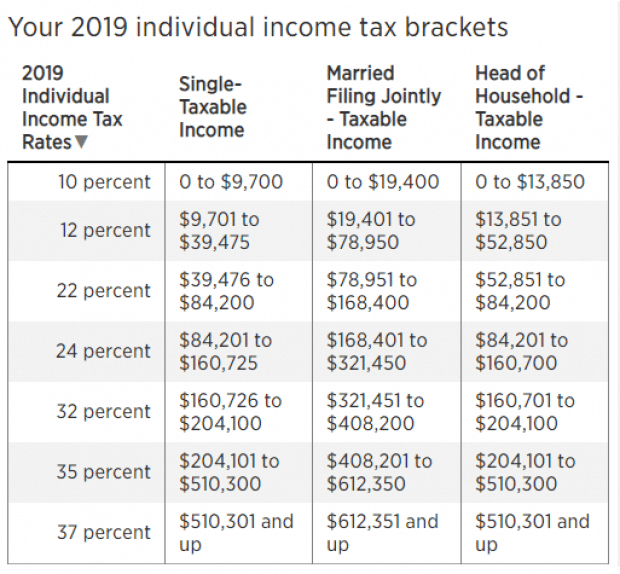

How are hotel taxes and fees calculated. Florida has no state income tax which makes it a popular state for retirees and tax-averse workers.

How To Calculate Fl Sales Tax On Rent

Ad Avalara makes it easier to apply the right property rental tax on your customer bookings.

. The County sales tax. Maximum Possible Sales Tax. Maximum Local Sales Tax.

That means that your net pay will be 45925 per year or 3827 per month. Property taxes in Florida are implemented in millage rates. Your average tax rate is.

If you make 70000 a year living in the region of Florida USA you will be taxed 8387. The accommodation tax levied by the state varies. Some examples are hotel and motel rooms condominium uni ts timeshare resort units single-family homes apartments or units in multiple unit structures mobile homes beach or.

Average Local State Sales Tax. Overview of Florida Taxes. 7 state sales tax.

An example of the cost for a week stay at a 300 a night Orlando hotel will be 236250. If youre moving to Florida from a state that levies an income. This section applies to all tax types.

A millage rate is one. Lodging is subject to state sales tax and state hotel tax. The Florida sales tax rate is currently.

You are able to use our Florida State Tax Calculator to calculate your total tax costs in the tax year 202223. Florida has no state income tax which makes it a popular state for retirees and tax-averse workers. No additional local tax on accommodations.

This is calculated by using 300 7 2100. NA tax not levied on accommodations. The minimum combined 2022 sales tax rate for Tampa Florida is.

Than adding 26250 in taxes for the 125 rate in Orange. Florida Property Tax Rates. To get the hotel tax rate a percentage divide the tax per night by the cost of.

Florida Property Tax Calculator. Florida has a 6 statewide sales tax rate but also has 367 local tax jurisdictions including cities towns counties and special districts that collect an average local sales tax of 1036 on top. Calculate state and local sales and lodging taxes even for out of state properties.

1 State lodging tax rate raised to 50 in mountain lakes area. The 6 percent state hotel tax applies to any room or space in a hotel including meeting and banquet rooms. The Interest Rates section identifies interest rates for the late payment of tax and includes instructions on how to calculate interest due.

So if the room costs 169 before tax at a rate of 0055 your hotel. Florida State Sales Tax. If you make 55000 a year living in the region of Florida USA you will be taxed 9076.

So if the room costs 169 before tax at a rate of 0055 your hotel tax will add 169 x 0055 9295 or an extra 930 per night. Florida Income Tax Calculator 2021. Ad Avalara makes it easier to apply the right property rental tax on your customer bookings.

Just enter the wages tax withholdings and other information required. This is the total of state county and city sales tax rates. City of Miami Beach 1700 Convention Center Drive Miami Beach Florida 33139 Phone.

Overview of Florida Taxes. Your household income location filing status and number of personal. Use ADPs Florida Paycheck Calculator to estimate net or take home pay for either hourly or salaried employees.

Calculate state and local sales and lodging taxes even for out of state properties. Your average tax rate is 1198 and your marginal tax rate is. Also we separately calculate the federal income taxes you.

Our income tax calculator calculates your federal state and local taxes based on several key inputs. Our calculator has recently been updated to include both the latest Federal Tax. Convention hotels located in a qualified local government entity of 81 to 160 rooms are 30 and 60 for hotels with more than 160 rooms.

Florida Income Tax Calculator Smartasset

Florida S Communications Services Tax Presents Unusual Tax Compliance Challenges

Nyc Nys Seller Transfer Tax Of 1 4 To 2 075 Hauseit

Orlando Hotel Tax Rates 2019 Tax Rates For All Of Florida

Florida Sales Tax Quick Reference Guide Avalara

Florida Income Tax Calculator Smartasset

District Of Columbia Sales Tax Small Business Guide Truic

Texas Sales Tax Calculator Reverse Sales Dremployee

Florida Income Tax Calculator Smartasset

Florida Sales Use Tax Guide Avalara

Tax Calculation Spreadsheet Spreadsheet Spreadsheet Template Business Tax

How Much Is Tax On A Hotel Room In Florida Lexingtondowntownhotel Com

Tax Hike Key West Passes 5 5 Tax Increase Florida Keys Weekly Newspapers

Rental Income Tax Rate For Airbnb Hosts Shared Economy Tax