what is a secondary property tax levy

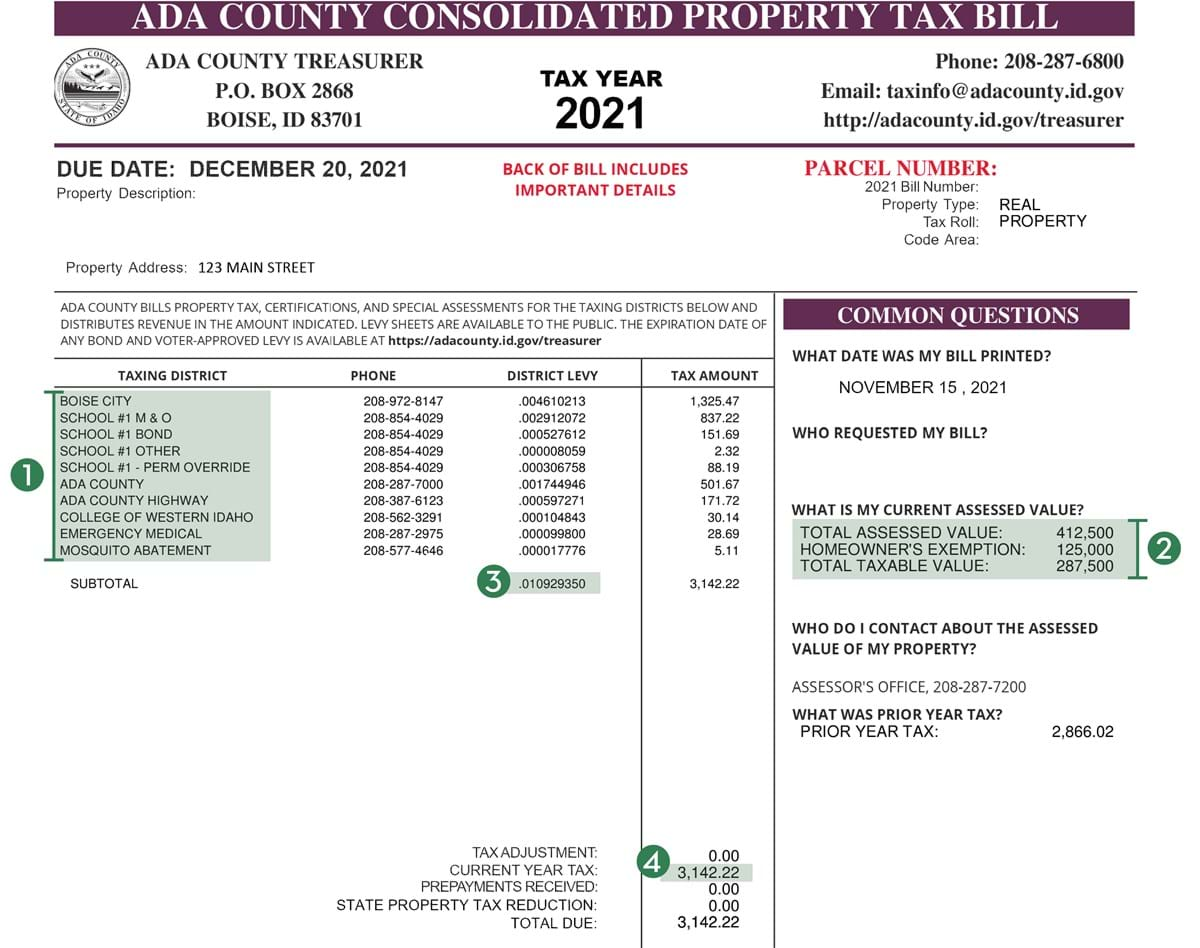

For more information on FUSDs 2019 property tax rates click here. Certain districts levy based on acreage Numbers 5 19 such as Electrical Water and Irrigation versus valuation.

Property Tax In Colorado Post Gallagher What Can Be Understood From Other States Common Sense Institute

Paying your levied property tax on time is important.

. The value of each property in the City is determined annually by either Maricopa County or the State. SD1 Flagstaff - primary tax levy for FUSD. West Virginia has one of the lowest median property tax rates in the United States with only two states collecting a lower median property tax than.

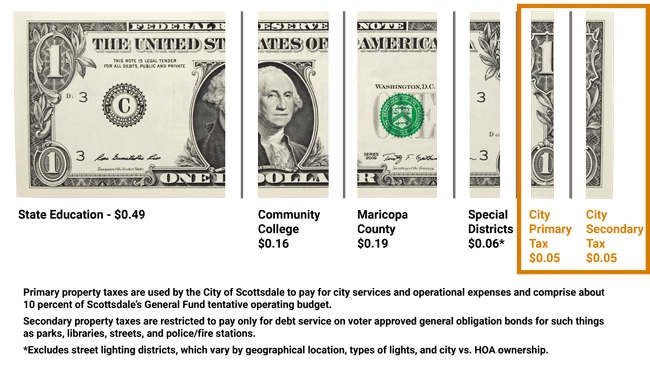

Property tax is a levy based on the assessed value of property. Property tax bills cover the calendar year. These two rates together comprise the Citys total property tax rate.

In addition to the governments ability to impose a tax the word levy also refers to the governments power to seize property to satisfy. Property owners will also incur an additional 00194 per 100 of assessed value to help offset the assessment cost. Levies are different from liens.

Therefore not paying your property taxes can result in the government seizing your property as payment. Refer to number 4. Property tax has two components.

15 that the City of Surprise intends to update the secondary property tax rate for the following street light improvement districts. A property tax levy is the right to seize an asset as a substitute for non-payment. The secondary tax is comprised mainly of commitments to satisfy bond indebtedness of jurisdictions fund voter-approved budget overrides and to support the operations of the special taxing districts such as fire flood control street lighting and other limited purpose districts in which your property is located.

This varies for each property depending on the value assigned by the assessors office. The City uses the tax levy not the tax rate to manage the secondary property tax. Property owners who have not received a tax bill by the first week of June can request a copy of the bill by visiting property tax document request.

Secondary Property Tax SEC. Property tax is a tax assessed on real estate. The median property tax in West Virginia is 46400 per year for a home worth the median value of 9450000.

301 West Jefferson Street Phoenix Arizona 85003 Main Line. AMPHI DESEGREGATION and TUSD DESEGREGATION adopted as secondary property taxes but included in computing the State Aid to. The limited property value used to calculate primary and secondary taxes is limited to a 5 increase per year mandated by Arizona state statute.

Only property owners are responsible for paying property taxes. The City collects a secondary property tax which is used to pay the principal and interest due for debt associated with General Obligation Bonds. The tax levy is calculated using the formula to the right.

FY 202122 Tax Rate per 100 NAV FY 202021 Tax Rate per 100 NAV. A lien is a legal claim against property to secure payment of the tax debt while a levy actually takes the property to satisfy the tax debt. 9 - 499.

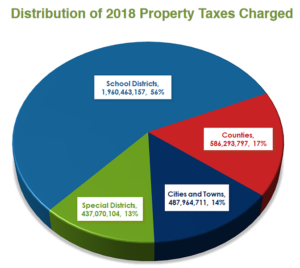

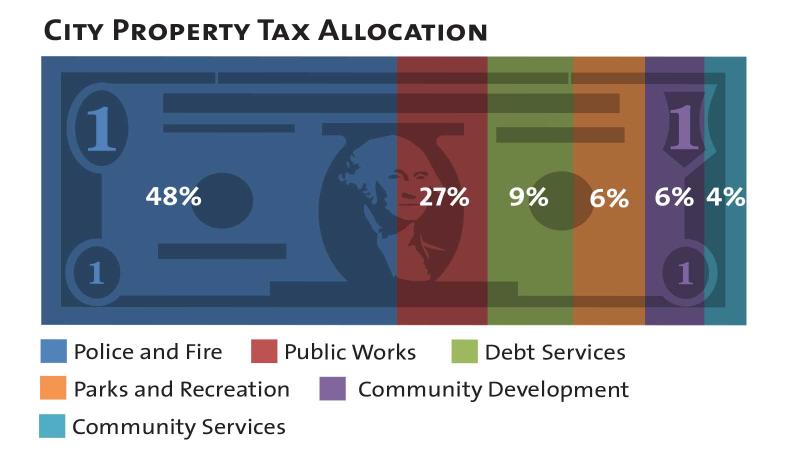

Governments enforce a property tax levy as a measure of last resort. The Pima County Property Tax Help Line can answer questions about how your property tax was calculated. Property taxes are one of the primary if not the only ways for municipalities to raise revenue for community services.

14 Special District Tax. Counties in West Virginia collect an average of 049 of a propertys assesed fair market value as property tax per year. It can garnish wages take money in your bank or other financial account seize and sell your vehicle s real estate and other personal property.

The tax is usually based on the value of the property including the land you own and is. Where does Internal Revenue Service IRS authority to levy originate. Prior to 2019 CCC also levied a secondary property tax which was not renewed by voters.

A municipal portion and an education portion. A property tax levy is known as an ad valorem tax which means its based on the ownership of something. Comprised of the total of the obligation for Special Taxing Districts voter approved bonds and budget overrides that are assessed on valuation.

In a two-tiered municipality a component of the rate is set by the upper-tier and a component is set by the lower-tier municipality. A Tax Levy is the amount of money to be raised by property taxation and is reported annually by each district residents approve the tax levy. A levy is a legal seizure of your property to satisfy a tax debt.

An IRS levy permits the legal seizure of your property to satisfy a tax debt. The 374 increase will equate on average to 730 for a 300000 home. The idea of a levy is that the government will take the property because you are unable.

The tax levy was considered for first reading at the Village Board Meeting on November 4 2021 and for a secondfinal reading on November 18 20201 at which time it was approved. FY 202021 Tax Levy chg. Flagstaff Unified School District 1.

Currently the tax rate for residential housing is 11233 per 100 of the assessed value and 12173 or other residential property. Those who rent or lease their residences will not have to pay property tax unless that payment is mentioned explicitly in the lease agreement. If you receive an IRS bill titled Final Notice of Intent to Levy and Notice of Your Right to A Hearing contact us.

Secondary property taxes provide funding for voter-approved bonds which fund construction of public facilities and infrastructure. A Tax Rate is is the percentage used to determine how much a property owner will pay per one hundred dollars of net assessed value. The secondary tax is calculated using the Limited Value of your.

For additional questions on tax rates and CCCs budget please contact CCC at 928 527-1222. The rates for the municipal portion of the tax are established by each municipality. Towns and cities use the proceeds from levying property taxes to fund the.

Since 2006 the amount of the secondary property tax levy has ranged from 008 cents to 019 cents per 100 of assessed value and the total amount collected has gone from 40 million to this year. Non-residential property tax rate is 21860 per 100 of assessed value. The property tax rates will be discussed and adopted by the Surprise City Council on June 21 2022 at or after 600 pm at City Hall Council Chambers located at 16000 N.

Demystifying Utah S Property Tax Law And Why We Have The Best Property Tax Laws In The Nation Utah Taxpayers

Pdf The Property Tax In Developing Countries Current Practice And Prospects

Understanding California S Property Taxes

Understanding California S Property Taxes

Property Tax In The Netherlands

Property Tax Calculation Boulder County

Around 40 Property Owners In Bengaluru Don T Pay Tax The Economic Times Paying Taxes Economic Times Bengaluru

Pin On Economic Perceptions Of China

Thankyou Cheers To The Beginning Of The New Financial Year 2021 2022 May The New Year Be Only About Prosperity And Profit Yo In 2021 Cheer Financial How To Plan

Income Statement Template 40 Templates To Track Your Company Revenues And Expenses Template Sumo Income Statement Statement Template Income

Secured Property Taxes Treasurer Tax Collector

Nse Turnover Drops By 30pc In Second Quarter Capital Market Investing Investors

Council Approves 2022 Tax Levy City Of Bloomington Mn

City Of Scottsdale Truth In Taxation Notice

Mississauga Property Tax 2021 Calculator Rates Wowa Ca

Pdf The Property Tax In Developing Countries Current Practice And Prospects

.jpg)